Introduction

Investing in the stock market can be a lucrative venture if done with adequate research and understanding. One stock that has caught the attention of many investors is Engineers India Limited (EIL). In this article, we will analyze the share price trends of EIL, explore the factors that influence its stock price, and provide insights for potential investors.

Share Price Analysis

Historical Performance:

EIL is a leading engineering consultancy and EPC company, providing a range of services in various sectors such as refineries, petrochemicals, pipelines, offshore, and infrastructure projects. The company’s share price has witnessed fluctuations over the years, influenced by various internal and external factors.

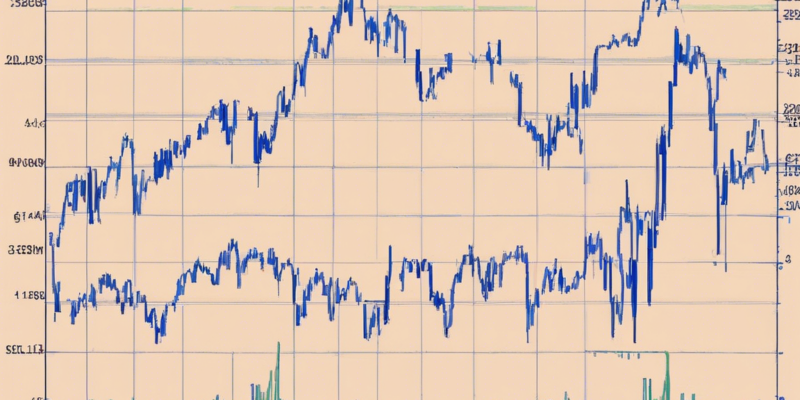

Technical Analysis:

Technical analysis involves studying past market data, primarily price and volume, to predict future price movements. Analysts use various tools and techniques like moving averages, MACD, and RSI to identify trends and potential entry/exit points for trading EIL shares.

Fundamental Analysis:

Fundamental analysis focuses on evaluating a company’s financial health and market position. Key metrics like earnings per share (EPS), price-to-earnings (P/E) ratio, and return on equity (ROE) can help investors determine the intrinsic value of EIL stock and make informed decisions.

Market Sentiment:

Market sentiment plays a crucial role in determining stock price movements. News, rumors, analyst reports, and macroeconomic factors can influence investor sentiment towards EIL, leading to buying or selling pressure.

Factors Influencing EIL Share Price

Industry Performance: The overall performance of the engineering and construction industry, including government policies, infrastructure projects, and global trends, can impact EIL’s share price.

Company Performance: EIL’s financial results, order book, project execution, and client relationships are critical factors that drive investor confidence and, in turn, the share price.

Macro-Economic Factors: Economic indicators like GDP growth, inflation, interest rates, and currency fluctuations can impact the stock market, including EIL’s share price.

Regulatory Environment: Changes in regulatory policies, licensing requirements, environmental regulations, and government contracts can have a direct impact on EIL’s business prospects and share price.

Competitive Landscape: Competition from domestic and international players in the engineering consulting and EPC space can influence EIL’s market position and, consequently, its share price.

Investment Outlook

While past performance and technical indicators provide valuable insights, investing in the stock market carries inherent risks. It is essential for investors to conduct thorough research, diversify their portfolio, and seek advice from financial experts before making investment decisions.

FAQs (Frequently Asked Questions)

1. Is EIL a good investment option for long-term investors?

– EIL can be a suitable investment for long-term investors, considering its strong track record, industry expertise, and growth potential in the engineering and construction sector.

2. What are the risks associated with investing in EIL shares?

– Risks include market volatility, regulatory changes, project delays, competition, and macroeconomic factors that can impact EIL’s business performance and share price.

3. How can investors stay updated on EIL’s stock price trends?

– Investors can monitor EIL’s share price through financial news platforms, stock market websites, company announcements, and by studying technical and fundamental analysis reports.

4. What strategies can investors use to mitigate risks when investing in EIL?

– Diversification, setting stop-loss orders, conducting thorough research, and consulting with financial advisors can help investors mitigate risks associated with investing in EIL shares.

5. How does EIL compare to its industry peers in terms of financial performance?

– Investors can compare key financial metrics like revenue growth, profit margins, return on equity, and debt levels to assess how EIL fares against its industry peers and make informed investment decisions.

In conclusion, analyzing EIL share price trends requires a comprehensive understanding of the company’s performance, industry dynamics, and market sentiment. By conducting thorough research, monitoring key indicators, and staying informed, investors can make informed decisions when considering EIL as a potential investment opportunity.